in this blog publish we can discover the Quasimodo – QML chart sample in depth.

Quasimodo(QML) is a reversal chart sample if shaped at a better time frame aid or resistance degree can suggest the alternate of fashion.

What’s QML(Quasimodo) Chart sample?

As cited in advance QML(Quasimodo) is a reversal chart sample and widely utilized by the day traders to assume fee reversal from a key level like better time body supply or call for and help or resistance degree.

it is indicated via the better high and lower low on the give up of bullish trend or lower low and higher excessive on the quit of bearish fashion.

So on the premise of fashion QML sample has two types explained below.

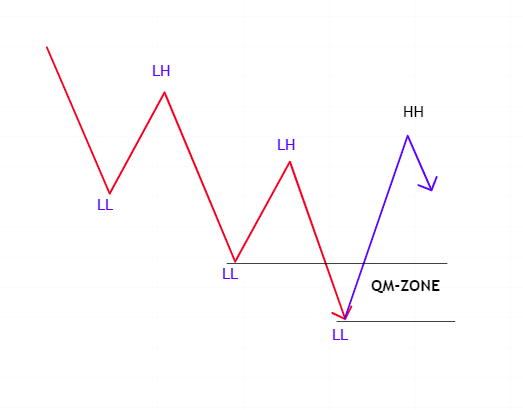

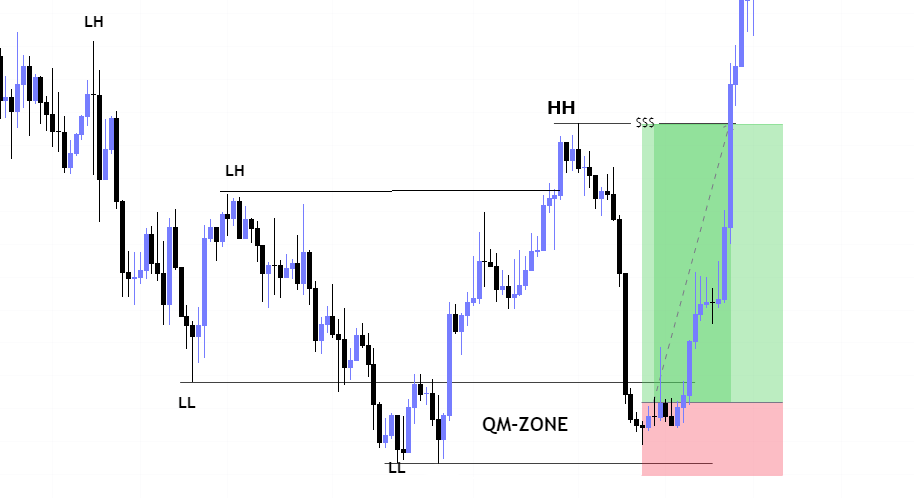

(I) Bullish QML(Quasimodo) sample

Bullish QML(Quasimodo) pattern is fashioned at the quit of bearish trend at a key stage.

As you know in bearish fashion charge makes lower lows and lower highs, but when it reaches a key assist level and price makes a higher high violating the preceding lower excessive then a structure with decrease low and better high is fashioned that is known as bullish QML pattern.

It indicates the reversal of rate from bearish fashion to bullish.

How to Trade Bullish QML Pattern?

To change a Bullish QML pattern:

(I) perceive the second-to-remaining low and the ultimate low before the formation of QML.

(II) Mark the vicinity between those lows (QML location).

(III) look for imbalances, demand zones, or FTR tiers in this place.

(IV) Execute a bullish trade when the price taps this area, or wait for a confirmation like a Market Structure Shift on a lower time frame.

(V) Place your stop-loss below the last low (QML low) and target the last high (QML high) for take profit.

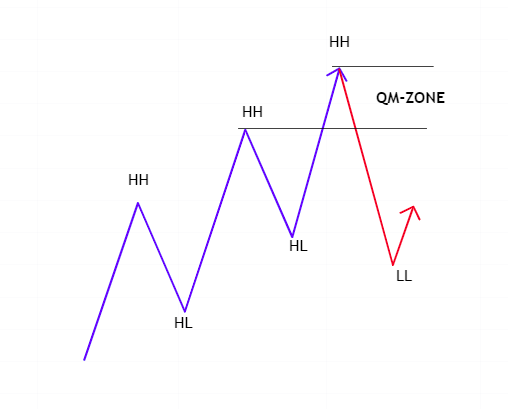

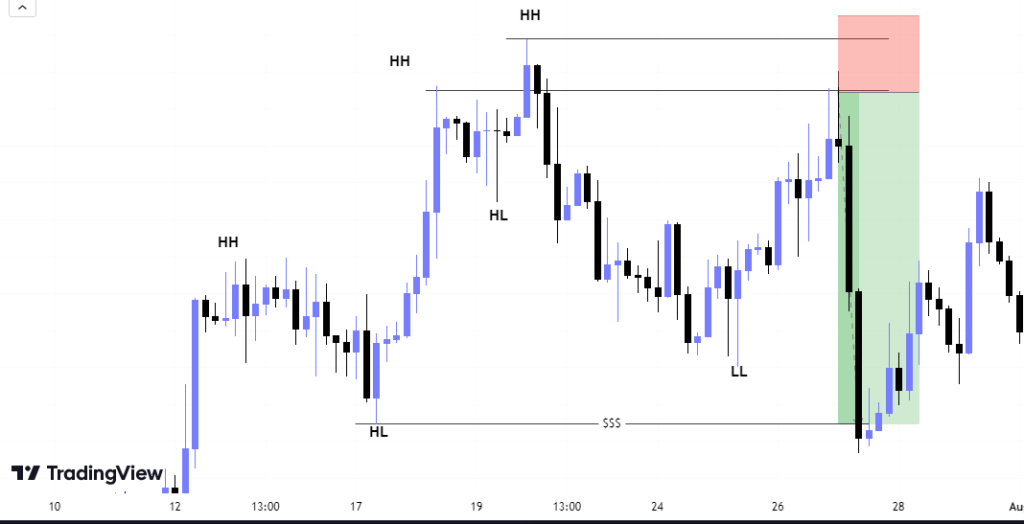

(II) Bearish QML(Quasimodo) pattern

In a bullish trend, the price makes higher highs and higher lows. however, while it reaches a key resistance level after which makes a lower low, breaking the preceding better low, it bureaucracy a structure known as a bullish QML (Quasimodo) pattern.

This sample suggests a capability reversal from a bullish trend to a bearish trend.

How to Trade a Bearish QML Pattern

To change a Bearish QML pattern:

(I) become aware of the second-to-ultimate excessive and the last high before the formation of QML.

(II) Mark the location among these highs (QML place).

(III) look for imbalances, deliver zones, or FTR tiers on this area.

(IV) Execute a bearish exchange when the price taps this area, or await a affirmation like a market structure Shift on a lower time body.

(V) area your prevent-loss above the closing excessive (QML high) and goal the last low (QML low) for take earnings.

Basis of QML Pattern

QML pattern is basically based on the concept of Change of Character (CHOCH), as we know when price changes its trend and breaks the lower high or higher low in bullish/bearish trend its called change of character which is a smart money concept.

But some times it may indicate reversal of price before the CHOCH happens because every high/low is not a structural high and the QML may form without breaking the structural high/low.

Why is the QML pattern significant in trading?

The QML pattern is significant because it helps traders identify potential trend reversals at key levels, allowing them to enter trades with a higher probability of success.

Can the QML pattern be used on any time frame?

Yes, the QML pattern can be used on any time frame. However, it is most effective when identified on higher time frame support or resistance levels.

How is the QML pattern used by traders?

Day traders use the QML pattern to anticipate price reversals from key levels such as higher time frame supply or demand zones, and support or resistance levels. It helps in identifying potential turning points in the market.

I love this bro your QML pattern strategies shared keep it up bro

Thanks